The suspension of Rihanna music NFTs trading on OpenSea triggers controversy about digital assets offering fractional ownership

OpenSea‘s choice to halt secondary sales for one of Rihanna’s most famous songs, “Bitch Better Have My Money”, has caused frustration among users — many of whom are still buzzing about her red-hot performance at Sunday’s Super Bowl.

Quick Take:

- 205 Rihanna fans were sold a fraction of royalties from Rihanna’s song “Bitch Better Have My Money” via AnotherBlock NFTs.

- OpenSea stopped secondary sales of these digital assets over promising fractional ownership a future profit.

- AnotherBlock argues that similar projects on the secondary marketplace offer the same advantages.

- The NFTs are still tradable on other platforms. However, the restriction affects the project’s floor price.

Success Behind AnotherBlock’s Rihanna Drop

Rihanna’s Producer, Jamil Pierre (aka, DEPUTY), produced the track “Bitch Better Have My Money” alongside Kanye West in 2015. A few weeks ago, DEPUTY enlisted Europe-based crypto startup AnotherBlock to sell 0.99% of his streaming royalty rights. He distributed the song via 300 NFTs to 205 fans to achieve such goals.

Each token on the blockchain includes a 0.0033% ownership of royalty rights to the famous artist’s song. Thus, token holders are entitled to a percentage of the streaming rights from the prestigious recording.

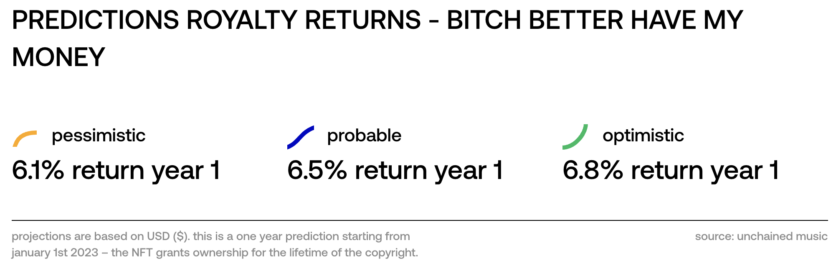

Matt Waters, Co-Founder of Unchained Music — the Web3 music distribution company who helped AnotherBlock analyze projected streaming returns of the drop — commented:

“Fractionalizing major music IP and giving fans a stake in the success of their favourite artists is a very clear use case of emerging NFT technology. Music rights have often been opaque, and fandom has been removed from directly benefiting from artists’ successes. AnotherBlock’s sellout and subsequent boost in streaming revenue proves that the demand is there from the fan side of the equation.”

It comes as no surprise that Anotherblock’s mint was a quick sell-out – generating a whopping $63K in revenue in little to no time.

OpenSea Suspends Trading of the Digital Assets – the Aftermath

Two days after the renowned NFT sales – just days after Rihanna’s Super Bowl appearance — buyers of the NFTs were no longer able to trade the digital assets on OpenSea.

The NFTs `flagged’ on the world-famous NFT marketplace’s automated system due to project description issues. However, AnotherBlock saw no issues with its project and was unsure why. Following this, the firm’s Head of Community and Growth, Andreas Bigert (aka “Bigleton”), contacted OpenSea for answers.

Bigleton posted OpenSea’s response to the company’s Discord, stating the collection’s sales were halted because the NFTs “promising fractional ownership and future profit based on that ownership.”

Since the response, AnotherBlock has been doing all it can to resolve the issue. The crypto startup replied to the marketplace’s team, saying that similar collections (like Corite and Royal) are still tradable on the platform despite having similar advantages. But OpenSea has been blanking AnotherBlock since its first and only response.

Luckily, it’s not the end of the world for the royalty-favoring collectibles. They are still tradable on AnotherBlock’s marketplace, alongside Blur (an NFT marketplace favored by professional traders).

One of the most significant issues regarding the ban includes affecting the NFT project’s overall floor price, causing frustration among AnotherBlock and buyers alike. Of course, principle also has a part to play.

Subscribe to the NFT Lately newsletter to receive news covering the latest NFT-related drops, releases, reviews, and more.