More than 30k Bitcoin made its way to major exchanges on Wednesday

Bitcoin exchange inflow sees the highest spike in 15 months, affecting both Binance and Coinbase alike.

Quick take:

- Bitcoin exchange inflow skyrockets for the first time since March 2020

- Major cryptocurrency exchanges received more than 30k BTC on Monday

- Binance obtained more than 80% of the total net inflow

- Investors transfer Bitcoin to Binance for purposes regarding alternative assets, like NFTs

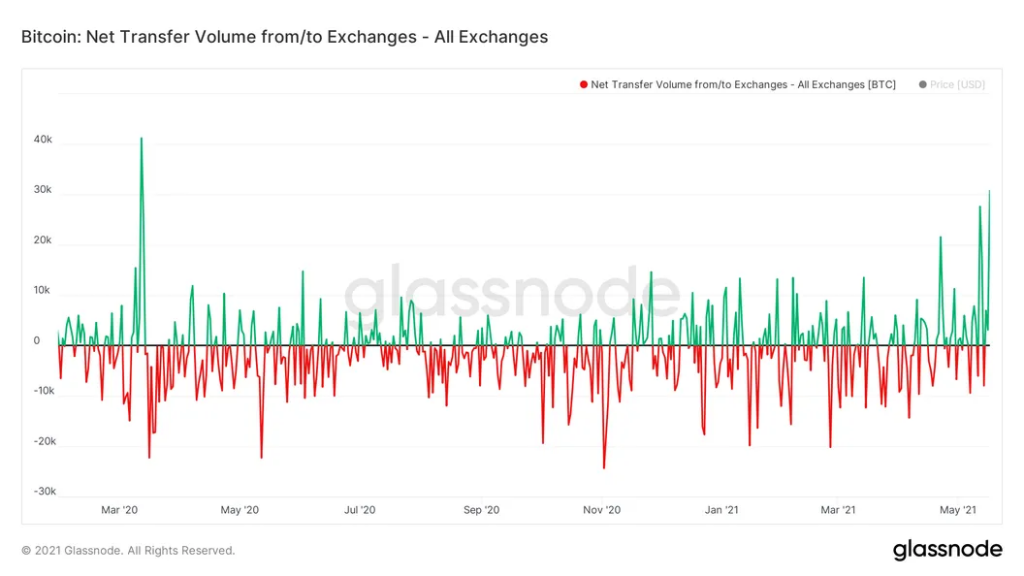

Data from Glassnode shows Bitcoin exchange inflow soaring to its highest since the blockchain network dipped to 3,600 BTC inflow in March 2020.

This graph shows that just two days ago, on September 14, more than 30k worth of Bitcoin made its way to major exchanges:

Differently, separate data from the Analytics hub Santiment shows that 1.69M BTC (currently the equivalent of $33.5 billion) was moved to exchanges from September 7 to September 14.

Santiment published this graph on Twitter, highlighting the largest weekly spike of BTC in 11 months:

“This was the highest amount of $BTC moved since October 2021,”

Tweeted Santiment.

Reasons for BTC Moving to Major Exchanges

In most circumstances regarding Bitcoin exchange inflow, investors transfer Bitcoins to exchanges when wanting to liquidate their holdings. To back up this theory, exchanges witnessed a net influx of more than 40,000 BTC on Black Thursday.

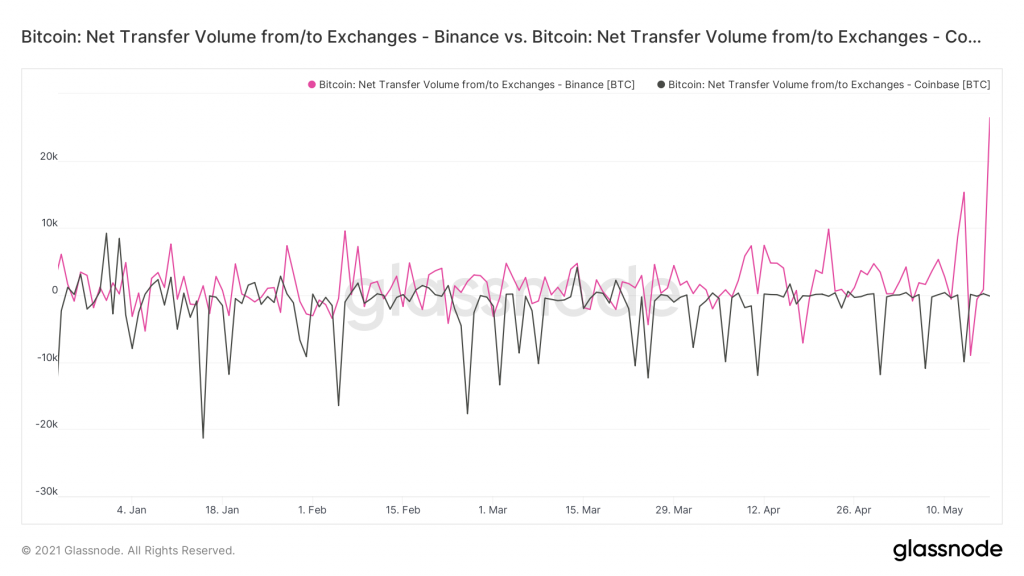

Interestingly, most Bitcoin exchange inflow was to Binance, which retail investors typically use. In contrast, Coinbase registered Bitcoin outflows.

“Coinbase has seen almost entirely net outflows of BTC since breaking last cycles $20,000 all-time high, a trend that has continued this week,”

published Glassnode in its weekly newsletter on Monday.

According to data from Glassnode, Binance obtained more than 80% of the total net inflow of 30,749.89 BTC on Monday. Coinbase saw a net outflow of 146 BTC:

Both exchanges have seen split trends regarding Bitcoin exchange inflow throughout the recent weeks. Coinbase’s balance declined by 34,408 BTC since April 19. In contrast, Binance’s BTC balance increased by 95,397 this month.

The reason for Binance picking up sharply in recent months is a sign of “volatility in Binance user macro sentiment,” according to Glassnode Insights.

Some investors also transfer Bitcoin to Binance for purposes regarding alternative assets, like NFTs.

Subscribe to the NFT Lately newsletter to receive news covering the latest NFT drops, releases, reviews and more.