NFT staking is a relatively new concept in the world of blockchain and cryptocurrency. In simple terms, NFT staking refers to the process of holding and “staking” non-fungible tokens (NFTs) in order to earn rewards.

But what exactly are NFTs, and what does staking an NFT mean? In this blog post, we’ll explore the basics of NFT staking and how it can potentially provide opportunities for earning passive income.

Understanding NFTs

First, let’s start with a brief overview of non-fungible tokens (NFTs). NFTs are a type of digital, blockchain-hosted asset that is unique and cannot be replicated or exchanged for an identical item. This is in contrast to cryptocurrencies like Bitcoin, which are interchangeable (or fungible) and can be easily traded for other cryptocurrencies or fiat money.

Some examples of NFTs include digital collectibles, like Cryptokitties, or digital art, like the record-breaking $69 million NFT sold by the artist Beeple. NFTs are often built on top of blockchain technology, which allows for the creation and authentication of unique digital assets.

What NFT Staking Means

Now, onto NFT staking. Just like with other cryptocurrencies, NFT staking allows holders of NFTs to earn rewards for holding onto their assets for a certain period of time. This process is often referred to as “proof of stake” or “delegated proof of stake.”

In order to participate in NFT staking, an individual must first purchase or acquire the NFT they want to stake. This can be done through a variety of means, such as buying the NFT on a marketplace or earning it as a reward for participating in a decentralized finance (DeFi) platform.Once the NFT is acquired, it can then be “staked” by sending it to a staking platform or protocol. This process typically requires the NFT holder to lock up their NFT for a specific period of time, often ranging from a few days to several months.

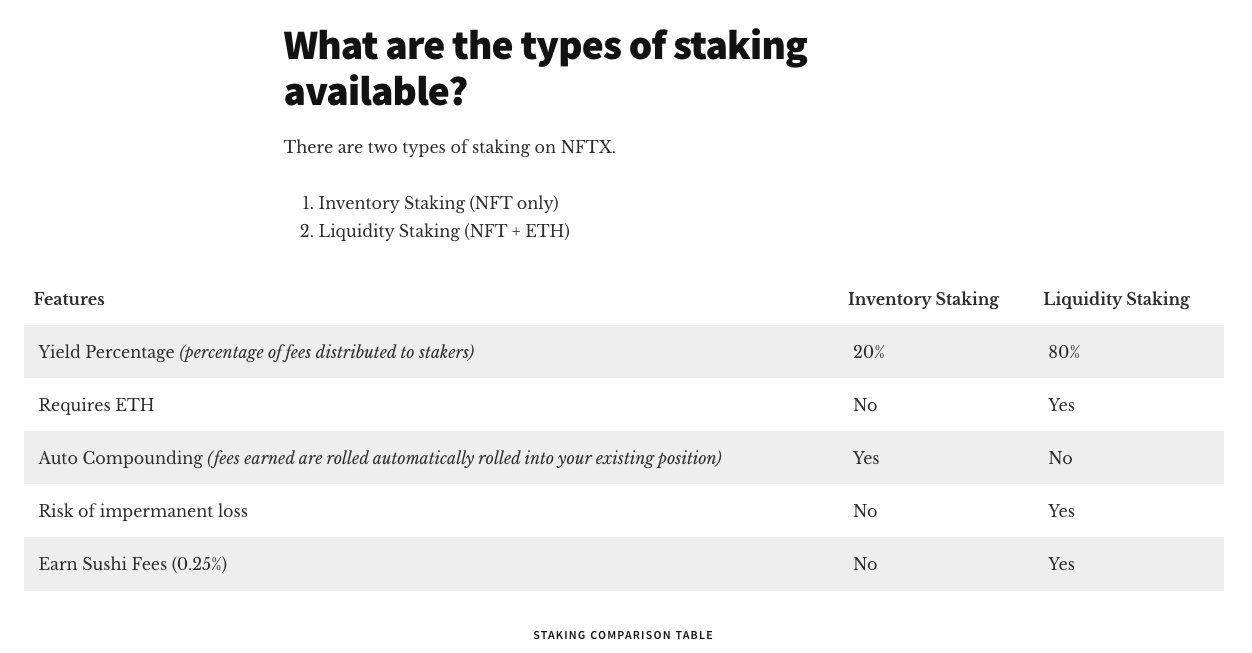

During this time, the staked NFT is used to help secure the underlying blockchain and validate transactions. In return for their contribution to the network, NFT stakers are rewarded with a share of the platform’s transaction fees or with new tokens that are generated by the platform.

The amount of rewards earned through NFT staking can vary depending on a number of factors, such as the value and rarity of the NFT being staked, the length of the staking period, and the overall performance of the staking platform.

One of the key benefits of NFT staking is the potential for earning passive income. By staking their NFTs, individuals can earn rewards without having to actively buy and sell the tokens or participate in complex trading strategies. This can provide a steady stream of income, especially for those who hold a large number of valuable NFTs.

Below is a screenshot taken from NFTX’s staking documentation. Here you can see an example of what type of rewards and financial incentives NFT staking can provide.

Additionally, NFT staking can also help increase the value and liquidity of NFTs. By staking their NFTs, individuals can help ensure that the assets remain in circulation and are actively used on the platform. This can help increase demand for the NFTs and potentially drive up their value.

Is Staking NFTs Safe?

Of course, NFT staking is not without its risks. As with any investment, there is always the potential for losses, particularly if the value of the NFT being staked declines or the staking platform experiences technical issues. It’s important for individuals to carefully research and evaluate the risks before committing to NFT staking.

Staking NFTs can be a relatively safe way to earn rewards for holding onto these unique digital assets. As with any investment, however, there are always risks involved.

One key risk to consider is the potential for technical issues or security breaches on the staking platform. If the platform experiences downtime or is hacked, this could result in losses for NFT stakers. It’s important to carefully research and evaluate the security measures in place on the staking platform before committing to staking your NFTs.

Another risk to consider is the potential for changes in the value of the NFTs being staked. If the value of the NFT declines, this could result in lower rewards or even losses for the staker. It’s important to carefully research and evaluate the potential risks and rewards before staking your NFTs.

Wrap Up

Overall, staking NFTs can be a relatively safe way to earn rewards for holding onto these unique digital assets. However, it’s important to carefully research and evaluate the risks before committing to staking your NFTs.