The co-founder of Arcade, Robert Masiello, shares his thoughts with NFT Lately about how fractionalized ownership can drive the next wave of NFTs

After Beeple’s record-breaking sale of an NFT for $69 million made headlines in the spring of 2021, a searing hot NFT summer kicked off—showing the potential these digital assets had to transform the concept of digital art sales.

While the overall NFT market is cooling, with raw sales data showing a downturn in new purchases, consumer and institutional interest in tokenized assets remains high.

A big reason for this growing interest on the part of institutions includes the realization of new investment opportunities—all of which are made possible through fractional ownership.

Creating Access to New Investment Opportunities

One exciting way NFTs create new investment opportunities is by enabling fractionalized ownership.

Fractionalized ownership is a novel method for individuals to gain exposure to different assets without having to invest the amount of capital required to own the entire property, art piece, or luxury item.

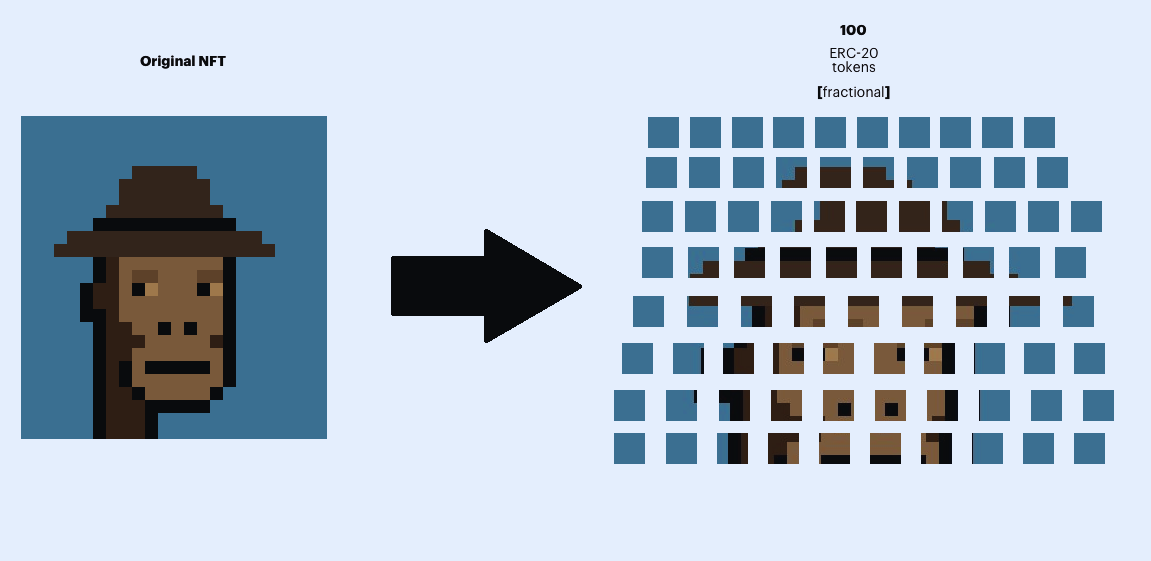

Rather, fractionalized NFTs allow dividing an existing, single NFT into multiple NFTs (fractions).

Curators create digital assets through smart contracts that assist in dividing a single NFT into a fixed number of tokens. Each one represents a percentage of the total asset’s value.

From whiskey and luxury brands to fine art, real estate, films, music, DAO memberships and more, communal-based ownership of fractionalized NFTs is becoming a common investment offering.

Theoretically, NFTs can tie to several different products, services, or assets and allow for the fractional ownership of virtually anything.

However, the future of communal ownership is exceptionally bright when it comes to opening up new asset classes that individuals wouldn’t necessarily have had the opportunity to gain exposure to before.

Look at LinksDAO, for example. It is a community of investors organizing the design and funding of a real-world golf course and leisure club. Users buy NFT membership passes and can choose their level of involvement with the project.

By spreading the project’s total cost across all DAO participants—and not restricting how many participants there are—NFTs offer all members partial ownership in real-world investments.

Better still, ownership rights that would usually be out of the economic range of the majority of community members.

Making High-Dollar Real-World Assets Affordable for Everyone

In 2019, Uniswap launched an experimental NFT project called Unisocks. Here, anyone who holds an ERC-20 compliant token can purchase $SOCKS and redeem their token for an actual pair of wearable socks.

Not only did $SOCKS hit an all-time high of more than $92,000 in 2021, but the project is a prime example of how NFTs can back real-world products, changing how they are bought and sold.

Regarding fractional ownership, NFTs can represent affordable pieces of highly sought-after and expensive physical properties and luxury goods in the same way Unisocks fused NFTs with apparel.

It’s important to note that fractionalization adds additional benefits not found in traditional ownership. Reasons include enabling individuals to invest in assets they usually would not support.

Luxury watches, such as the discontinued green dialed Patek Philippe Nautilus 5711, are seeing multiples as high as 1300% on the secondary market, selling for hundreds of thousands of dollars.

This price out of the question for the majority of the population. However, fractional NFTs allow individuals to buy in for as low as $100.

Additionally, in the fall of 2021, NFT platform Sm-ART announced it will auction off the first-ever Patek Philippe Nautilus NFT, allowing investors to own part of an asset they might not have been able to buy into before.

But this is just the beginning of the fractionalization of real-world assets. NFTs can represent shared ownership across real estate, fine wine, handbags, and any other physical good imaginable.

Moreover, NFTs can also define an on-chain attestation of a physical good you already own in real life. Then, you can mint the item, say a Rolex, as an NFT and leverage that investment in various ways on Web3.

Driving a Paradigm Shift for the Creator Economy

One of the narratives that allowed Web3 to gain significant ground in 2021 was the notion that the technology would unlock newfound opportunities for artists and creatives.

Unfortunately, today, many creative pursuits yield little financial return. Seeking funding for film and music production has many challenges.

Platforms like Royal and Sound.xyz allow consumers to own a stake in songs and albums via NFTs. As a result, musical artists can earn more from their work, and owners can earn royalties or gain access to exclusive communities.

NFTs can also enable fractionalized ownership of films, books, or paintings.

Moreover, the digital assets can help crowdfund artists who want to raise money for their projects without turning to traditional investment strategies or loans.

Moreover, fractionalized NFTs offer a whole new world of investment diversification—allowing fans to participate directly in the financial success of the creators they love.

No matter how badly the markets hit, DeFi is here to stay. NFTs offer so much utility and diversification.

The impact on the democratization of our financial system is just getting started.

By Robert Masiello, co-founder of Arcade