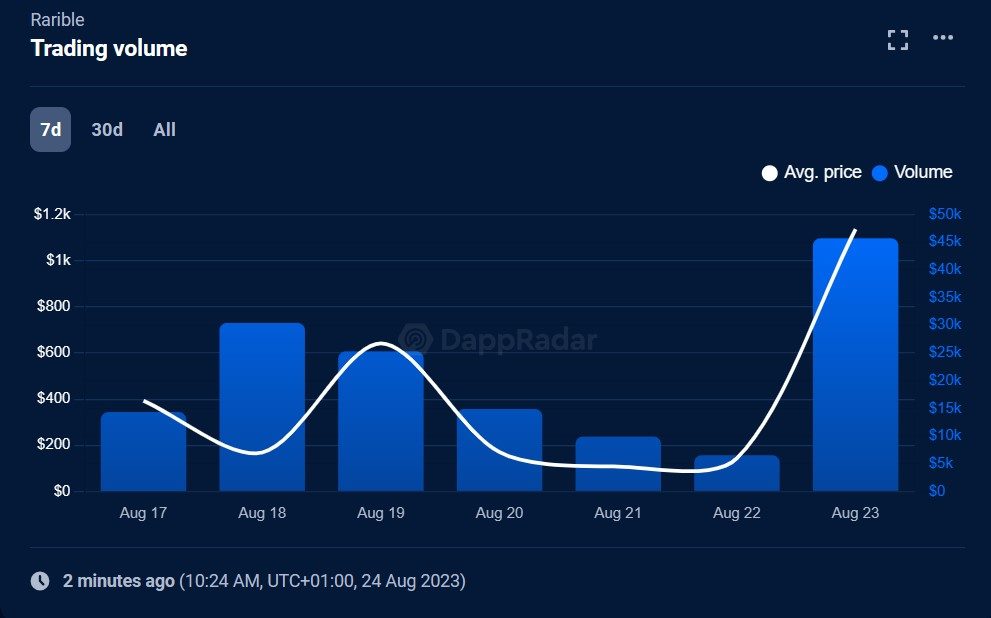

The NFT marketplace, Rarible, has a notable 24-hour spike in trading volume, soaring by 398.11% and touching over $45,000, according to DappRadar.

Rarible’s sudden boost in popularity was spurred by its strong advocacy for the support of NFT creator royalties — particularly in the wake of OpenSea ceasing its mandatory royalty tool.

Quick Takes:

- OpenSea’s choice to terminate its royalty enforcement tool has led to significant market shifts.

- Rarible is outpacing competitors in trading volume due to championing royalties.

- It also no longer aggregates orders from other NFT hubs, like OpenSea, lacking creator support.

The Impacts of Ignoring Creator Royalties

Although Rarible’s trading volume surge may appear modest compared to its rivals, the secondary marketplace outpaced OpenSea’s trading volume — a 24-hour volume drop of -14.43% — and LooksRare, which saw respective trading dip by -74%.

The cause of the marketplaces’ trading volume setbacks includes ignoring creator royalties. Interestingly, X2Y2 has a volume increase of +31.52% in 24 hours despite similarly omitting such creator support.

Following the deficiency in royalty commitments, Rarible is no longer aggregating orders from OpenSea, LooksRare, and X2Y2 commencing from September 30.

Controversies Surrounding Royalty Payments

There have been continuous debates surrounding intellectual property charges. In February, OpenSea began implementing a 0.5% mandatory creator royalty fee for NFT trades without on-chain enforcement, regarding creators paying a fee. The marketplace’s top rival, Blur, rose in popularity as a result — despite also not supporting such payments. Unlike OpenSea, however, Blur does not impose fees on sellers using its marketplace.

Moreover, on August 17, OpenSea revealed its intention to entirely cease its royalty enforcement tool by February 29 next year, following lousy support from community members. This has caused an uproar among NFT creators, with Yuga Labs turning its back on OpenSea — among others — as a consequence.

The landscape of secondary marketplaces is undergoing notable shifts. The nexus between NFT platforms, creator preferences, and public opinions exposes the evolving nature of the NFT realm and the crucial role of creator royalties in shaping the future of these trading hubs.

Subscribe to the NFT Lately newsletter to receive news covering the latest NFT-related drops, releases, reviews, and more.